January 16, 2004

Isaac Leung (P.Eng.) got a degree in Engineering Physics followed by a Master's in Electrical Engineering after which he promptly got a job as a product engineer at a company which makes high speed datacom chips. Following the dot-com meltdown, he's back at school studying biophysics and optical properties of semiconductors. He is old enough to have cut his computer teeth on Commodore 64's and first played with OS/2 1.3 EE while at a summer job with IBM. The first PC he ever owned came with Windows 95, but he soon slapped on OS/2 Warp 3 and has been Warping ever since. In between looking for a new job, he plots to take over the world.

If you have a comment about the content of this article, please feel free to vent in the OS/2 e-Zine discussion forums.

There is also a Printer Friendly version of this page.

|

Previous Article |

|

Next Article |

Home Finance Software

One of the tasks that many home users are faced with is managing their finances and making sure that their personal budgets are balanced. Unlike most governments, most of us typically do not have the freedom to run budgets that are billions of dollars in deficit. So, let's take a look at some tools that might help keep us out of the red!The last time I felt a need to use financial software, it was when Intuit's Quicken 98 reigned as king, and Microsoft Money was fast catching up. At the time, Quicken 98 more or less ran okay under WinOS2, so obviously that's the one I chose at the time. I have to admit, I was pretty ignorant about most OS/2 products.

This time, we take a look at some smaller offerings. Why? For starters, the "big guys"

don't run on OS/2. And secondly, as has been my experience, Intuit and Microsoft

are not exactly responsive to their customer demands. As we'll see, small doesn't mean

low quality or lack of great features!

The contenders

One piece of OS/2 financial software that I had heard of, and even tried, was InCharge!. However, it is not in the running this time, as we're just looking at personal finance software. Not that it couldn't be used as such. But from what I gather, it has a lot of professional features for real accounting work. As such, it is likely to be quite difficult to use for the average user (as I am) not steeped in the doctrine of professional accounting practice.That said, we still have 3 contenders that we are bringing to the party.

- Electronic Teller is probably the granddaddy of the bunch. It was around to see the Moneytree fiasco come and go, and is still alive, having received an update, with version 4.20 released just this past July 2003. As an aside, the same developer also makes Moneydance (no relation to Moneytree), which managed to survive some rather interesting times itself to live on and prosper under the original developer.

- Lastly, the baby on the block is PLCash, we'll see how it stacks up against the other two.

System Requirements

All of the 3, naturally, work under OS/2. However, only Electronic Teller is a native OS/2 PM application. The other two are Java applications, but I hope that fact won't deter you from evaluating them. Gone are the days of ultra-slow, sluggish performance. Today's Java applications are fast and light, even on this old machine, a PentiumII-300MHz laptop. And remember that Java is as native to OS/2 as Rexx, at least for Warp 4 and above. It just doesn't have the drag 'n drop hooks for WPS built in yet.

PLCash is small and light, at just 620kB, it will fit on an old floppy, however, it requires Java 1.4 (free from GoldenCode). Electronic Teller seems light, at less than 4MB for the download. But once unzipped and expanded, it manages to balloon to 12MB. Moneydance is the heavyweight, it's an 11MB download and expands to require over 14MB of your disk space. It also requires Java, but unlike PLCash, it is happy with Java 1.1.8, 1.3 or 1.4. The winner here is Electronic Teller, being lighter overall, and not requiring the capabilities of Warp 4 to function. On a faster machine, you may not notice the speed of Electronic Teller, but on a slower machine (such as 300MHz), Moneydance is marginally slower. Not much, but noticeable. I'll call it a tie between the other two, with PLCash being lighter, but Moneydance is much more flexible, being able to use all and any available JVM. "Slow" here is, of course, relative. None of the contestants were annoyingly so. My test machine being an old 300MHz laptop, I suspect that hardly anyone will have any useability issues with any of these pieces of software. I should note that out of the 3, PLCash was the only one to experience a crash during my evaluation.

Score:

Electronic Teller 3

Moneydance 2

PLCash 2

Installation

Fortunately, installation on any of the 3 are relatively painless. Electronic Teller comes in a .ZIP file. Just unzip it and run the included installation program. You can select several language interfaces, including French, German, Italian, Portugese Spanish, and both UK and US English. A nice folder is created on your desktop, populated by the application, as well as other little utilities.Moneydance also comes as a .ZIP file which you can just unzip into the directory of your choice. No installation is required. All you have to do is run the included MONEYDANCE.CMD file, which works very well at figuring out your Java situation. It worked flawlessly on my system to fire up the default Java 1.1.8 JVM.

PLCash, lightweight of the bunch, comes as a single .JAR file if you're running anything but Windows. You'll have to create a command file yourself to start it up. Fortunately, not too painful. Here's a sample:

SET JAVA_HOME=C:\Java141\jre SET HOME=E:\Programs\PLCash C:\Java141\jre\bin\java -Duser.home=E:\Programs\PLCash -jar PLCash.jar

We'll have to call it a tie for this round, between Moneydance's "no installation required" installation, and Electronic Teller's easy, comforting install.

Score:

Electronic Teller 3

Moneydance 3

PLCash 0

User Interface

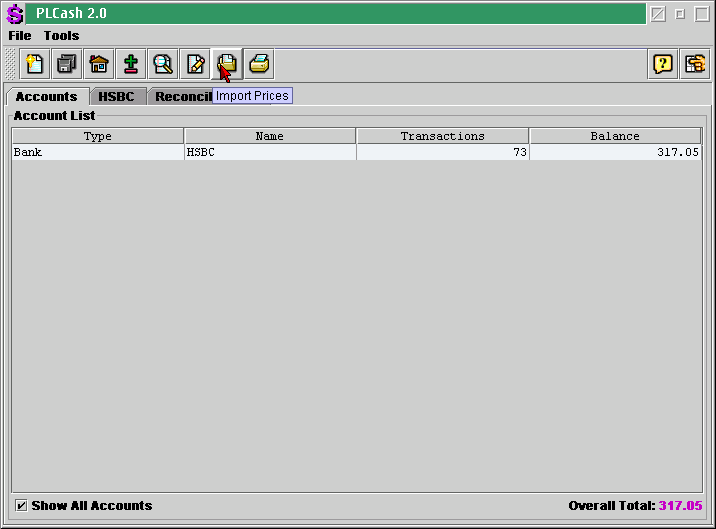

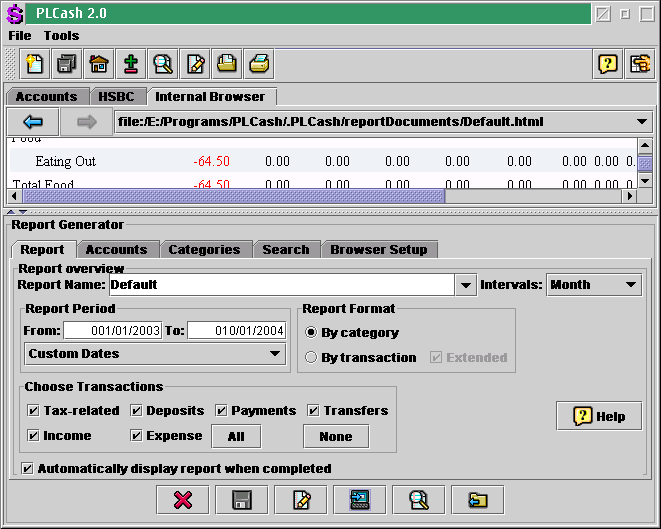

PLCash has the simplest, cleanest interface of all. This is likely due

to its relatively small feature set. Fly over help is available for the toolbar

on top.

Other than the help screen, there's only one window to deal with. Different

accounts are accessed via tabs. If there's any complaints about the interface,

it's that various tabs will be created depending on what function you've accessed.

For example, if you want to reconcile a particular account, a new tab appears

with the appropriate screen setup. Not terribly annoying, but I think a minor

foible nonetheless. Any tabbed notebook setup should have all tabs available at

all times.

(click on image to get full resolution screen shot)

If you want to edit a particular transaction, just double-click on it, as

you would expect. The Account screen will create a split and allow you to

edit the details. The split window is resizeable, and the fields are pretty standard.

One issue I had with the entry procedure was that I was required to enter a

Category for each transaction. If it was empty, I was asked to restart, and unfortunately,

PLCash means restart from the beginning and erases the amount I had previously

entered. Also, perhaps this is just me, but I didn't find the icons particularly

intuitive, and I had to rely on the flyover help to figure out which each did.

However, while I think there is plenty of room for improvement, I don't think

there are any "features" that are annoying enough to prevent anyone from using PLCash.

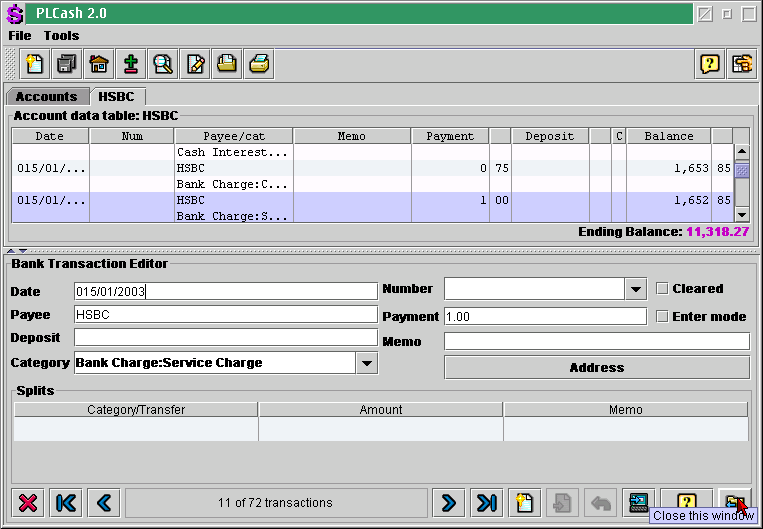

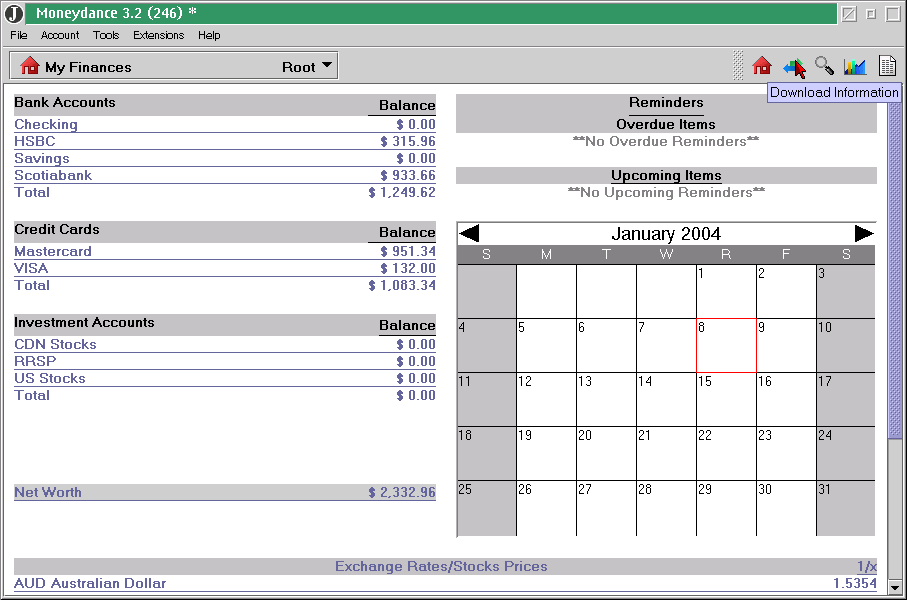

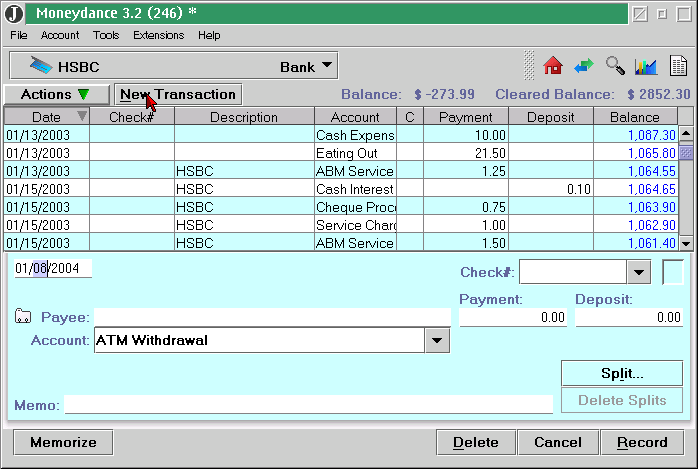

Users of Quicken will be at home with Moneydance. It has an almost familiar

layout. Well, more familiar than the other two at any rate!

(click on image to get full resolution screen shot)

Not too shabby. All the account information is listed on the left, and some

important reminders and calendar on the right, and exchange rates on the bottom.

You might find it a little confusing at first because the interface is so

sparse! There are only a handful of buttons on the left side and a short menu bar.

One thing that could've been improved is the ability to customize the interface a bit. The large space taken up at the bottom by the list of exchange rates seems to be a bit of a waste.

Rest assured, all functions are easily accessible. The icon toolbar can be "ripped"

off and stay floating. Rest your mouse over the icon for a few seconds and popup hints will

appear. The accounts are accessed via the pull-down dialog or by double-clicking on

the account name itself. Either way is nicely intuitive.

The account entry screen is not too strange either. You have a list of transactions

The window splits on the bottom when you click on "New Transaction" to allow you

to enter the transaction details, or when you select a transaction, it will allow

you to edit it. Nothing to complain about really. Nice and easy to use.

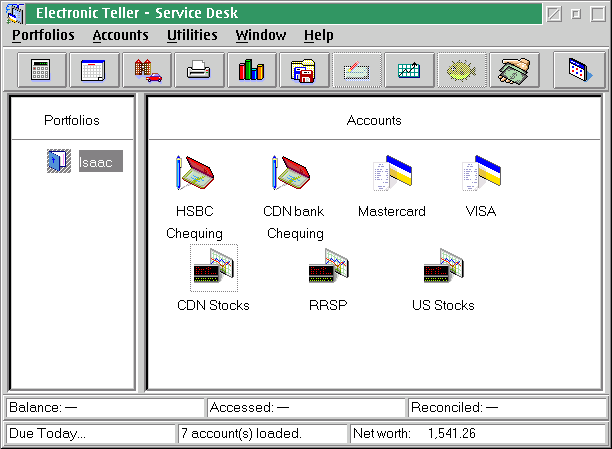

Electronic Teller goes a slightly different route, starting with the "Service Desk" which is actually a nice way to present all your accounts, and your portfolios. (All the buttons, of course, have fly-over hints). The concept of portfolios is actually a little bit unique to Electronic Teller. A "Portfolio" is a group of accounts which can interact with each other. Different portfolio's are ensured to be independent of each other (so it would be impossible to transfer between incorrect accounts), and can be individually encrypted. This can be accomplished in the other two applications by simply opening up a new file, but I feel that it is slightly more convenient using this presentation.

(By the way, there's no need to open up the Service Desk if you don't want to. All

your accounts are kept in a Portfolio, which actually looks and behaves like

a regular folder on your desktop. Open it up and you'll see all your accounts, and

as you'd expect, double-clicking any account will bring you straight to the account

window, bypassing the Service Desk).

Unlike Moneydance, the only information you see at your service desk is the

net worth for the active portfolio, and the balance for the highlighted account.

This may or may not be preferable for some users. Personally, I would probably

prefer to have an overall summary of my entire portfolio.

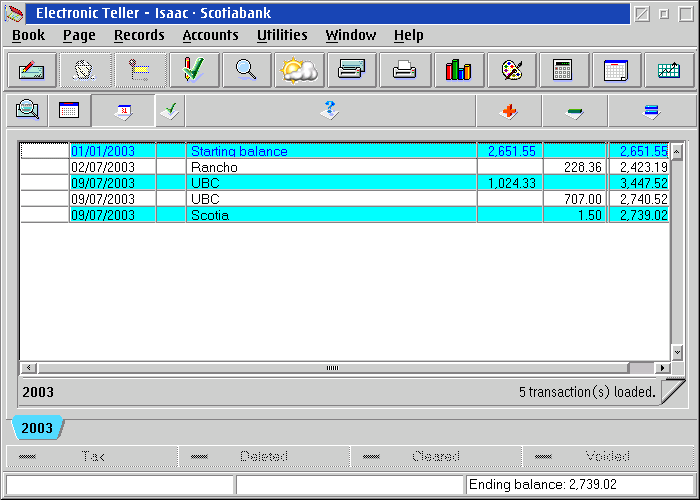

Double-clicking on the account will open up the main account window which

you'll be working with most of the time. The transactions are neatly grouped

by year via notebook tabs on the bottom. Nice touch! By the way, the coloured

alternating lines are customizable via drag 'n drop. I found this handy for

quick visual identification of each account, by changing the colour for each one.

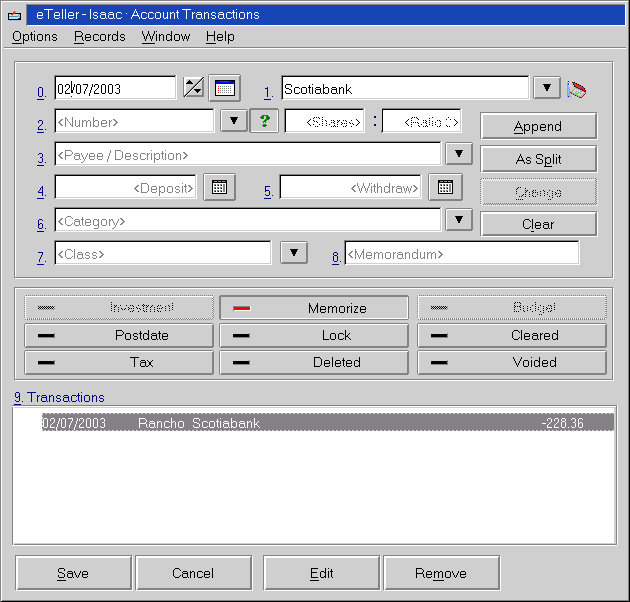

Double-clicking on an entry

or using the menus will bring up a screen to edit or add transactions.

I found this a little more hassle for entering one transaction than Moneydance,

but after using it a bit, I discovered it was much more efficient for

entering multiple entries, which I found myself doing most of the time as I

went through my month-end bank statements.

Another unique feature, is the ability to "Memorize" transactions, which I also

found very handy. One a transaction is memorized, it automatically fills in all

the fields the next time you start to type in the Payee/Description field. It

was a fabulous time saver for recurring costs such as gas, groceries, rent, etc.

Another one of the initially "odd" features is the delete behaviour. Odd until

you use it a bit! What Electronic Teller does when you initially delete a record

is not to actually delete it at all. It is merely crossed out, and ignored. It

still exists and is visible and readable until you explicitly delete it a second

time. Believe me, this turned out to be an absolutely wonderful feature!

On the whole, Electronic Teller seemed to offer a few more features (such as the ability to sort via category, class and add a memo note), but traded off a bit (very small) of ease of use. Moneydance looked nice and was easy to use for some of the commonly used tasks, but it also has its share of user-interface foibles. PLCash was not bad, but there was nothing about it that stood out either.

Score:

Electronic Teller 3

Moneydance 2

PLCash 1

Multi-Currency Support

PLCash is again the odd-man out, in its lack of support of multiple currencies. However, I suspect that this feature is probably not a "must-have" for a lot of people. Just the local currency probably handles 90% of the cases.

Both Moneydance and Electronic Teller support multiple currencies and their features are pretty much similar. You can import exchange rates and add or delete currencies as you wish. Moneydance has the ability to retrieve current exchange rates off Yahoo! while Electronic Teller comes with a rather substantial (dare I say complete?) list of the world's currencies.

Score:

Electronic Teller 3

Moneydance 3

PLCash 0

International Support

Hey, it may not be important to me, as I can easily parse English, but not everyone does. If you need something other than English, Electronic Teller is a good choice. Even if your favourite language (perhaps Icelandic?) isn't supported, the fact that 6 languages are currently available (French, German, Italian, Portugese, Spanish and English (both UK and US). suggests that perhaps only a mere translation of some key files are in order.

Moneydance also supports multiple languages, which you can change on the fly via the "Preferences" menu. Languages supported include English (again, both US and UK :-), French, German, Spanish, Norwegian, Italian and Portugese. For some reason, the Portugese doesn't seem to work. Changing languages takes annoyingly long, but I don't think this is a big issue, since it's not likely you'll change it but once at the beginning.

Java, properly done, should be able to handle multi-languages easily, as Moneydance shows. Let's hope that this will be implemented in the future into PLCash.

Score:

Electronic Teller 3

Moneydance 3

PLCash 0

Graphs

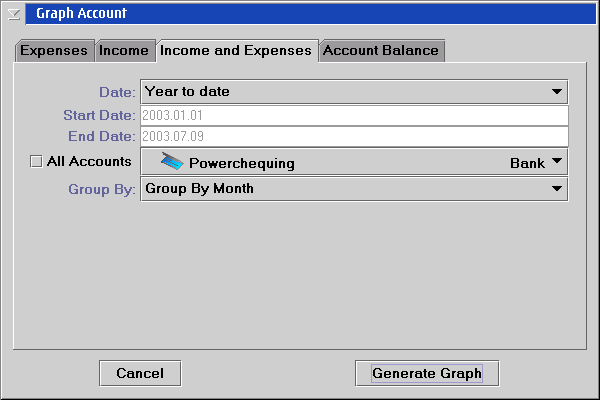

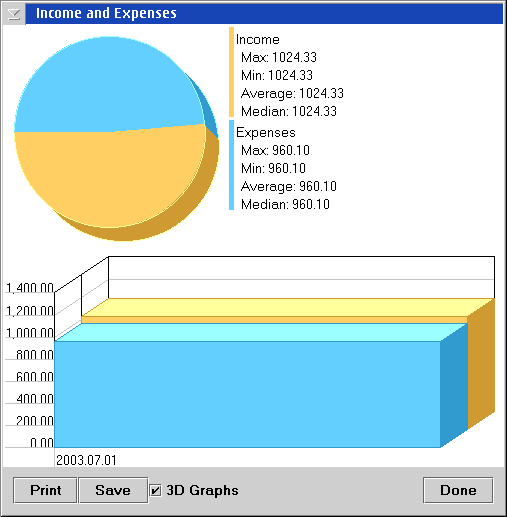

Only Electronic Teller and Moneydance currently have graphing capabilities. Moneydance's graphing capabilities are not bad. Just click on the graphing button (funny, no menu item for it) and select your options.

The options are relatively straightforward. Once you've selected what you want to graph, just click on the "Generate Graph" button.

For eye candy, you have the option of 2D or frivolous 3D graphs. I only have one complaint with the graphing here. When you select to graph either Income or Expense, you can break down the categories in the graph. However, when you select "Income and Expenses", everything is lumped into either income or expense category. Seems a bit of an oversight to me, as it would probably be quite common to look at your entire financial picture, with the categories.

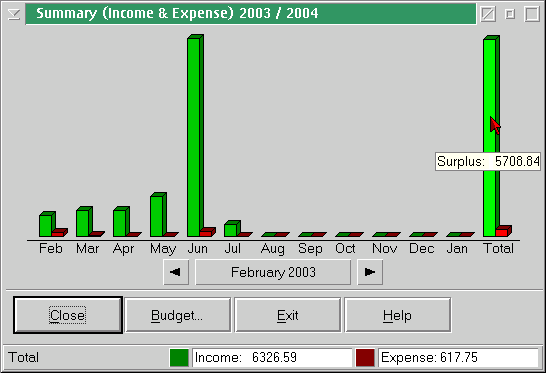

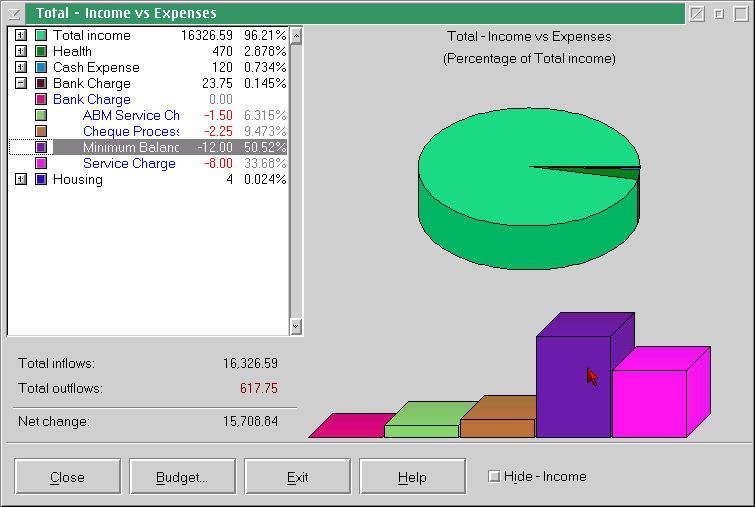

Electronic Teller manages to keep up with Moneydance and maybe even go one better.

You can ask for a graph from the text menu, icon button, from the service desk, or while

looking at the accounts. Anywhere!

The graph screen is nicely setup and easy to follow. Pointing your mouse at any

of the bar will bring up a popup that shows you the actual value of the bar.

While using it, I discovered another handy little feature. You can double-click

on any of the bars to get a more detailed graph.

Unlike Moneydance, Electronic Teller can break down each category (and you can

get even more detail by opening up the sub-categories using the navigation tree

on the left side. Even better, as you mouse-over the various areas in the graph,

the left side will highlight the appropriate category dynamically! Nice!

While Moneydance can break down your expenditures down to

the day, Electronic Teller can only handle down to the month. Also, Electronic Teller

has the option of hiding the Income category in the graph, which is a bit less flexible

than Moneydance's method.

In the end, the only clear "loser" is PLCash. Whether Moneydance comes out on top or Electronic Teller depends on which feature set is more important to you, but they're pretty close.

Score:

Electronic Teller 3

Moneydance 3

PLCash 0

Reports

All of our contestants offer a "Reports" feature, which basically summarizes your transactions, much like a monthly bank statement. PLCash's reporting feature is actually fairly feature intensive, with the ability to report on selected categories, or income/expense or bill payments only or tax-related options, etc.

The report is generated in yet another split of the current window. This is confusing at first if your window isn't maximized and you don't realize that a tiny split has been generated. The report is basically arranged with the dates running horizontally across the top and different categories listed and totalled vertically. I found this layout the least desirable, but your preferences may differ.

Moneydance, surprisingly, appears to be the least feature rich of the 3

when it comes to generating a report. However, it is easy to use and contains

the basic options (such as sub-totalling by various date ranges or account, or

other categories). In addition, you can generate reports on your budget or cash

flow or even missing checks (Does that happen a lot to most people?).

The report opens up in a new window, and as you can see, looks pretty much

like an average bank statement. While well arranged, I'm not sure it offers

that much extra benefit compared to viewing your account "online".

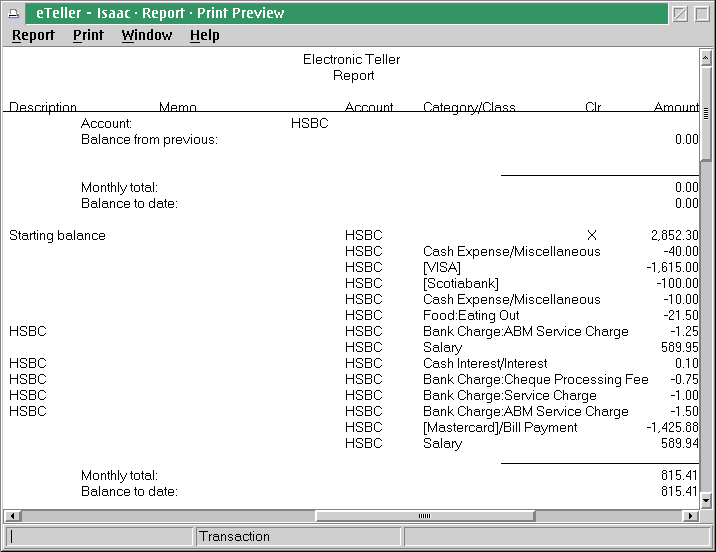

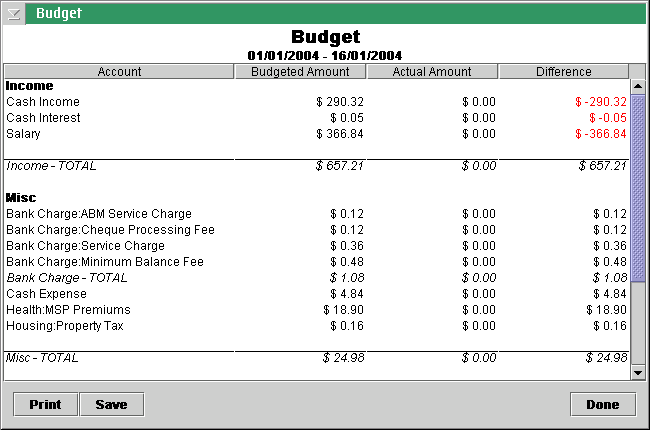

Electronic Teller again seems to have the most features here, with all of

the abilities of the other 2, including generating reports for budgets as well

as your usual transactions (and even for transaction fees, unreconciled checks

and a few others). The various reporting categories are also the most feature-rich,

with the ability to handle various date ranges, categories, by payee, by single or family

transactions and many more.

In my opinion, the report format is the most well-layed out and informative

of the three. However, the drawback is that it is really meant for hardcopy

(to be fair, so are all the other reports),

so you'll have to either print it out, or maximize the window on a really

big monitor to be able to see everything.

Score:

Electronic Teller 3

Moneydance 2

PLCash 2

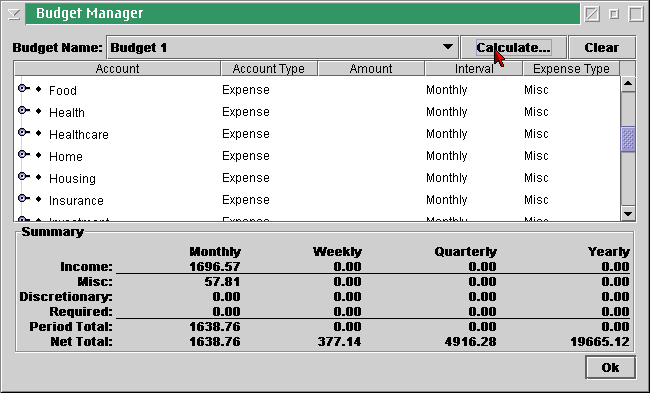

Budgeting Tools

Yes, you guessed it, down to Electronic Teller or Moneydance as PLCash is still

growing up. Moneydance starts with the "Budget Manager".

In the "Budget Manager" screen, you set the amounts you expect to spend under

each category. As you can see, there are a lot of categories, some of which

are entirely useless to me. (I haven't yet figured out how to customize

the categories. See my gripe about the documentation). Fortunately, there is a nice

helper at hand. The "Calculate" button will automatically generate a budget

based on your past expenditures. It certainly speeds up the setup a bit.

To get at your actual budget report, you have to go ask for it under the "Reports" function. While it seems to make sense as you read about it here, it's actually a bit cumbersome not to have the feature at hand when you set up your budget. (Though of course, that might not be an issue for you if your usage patterns differ from mine). However, under "Graph", there is no function to plot your budget.

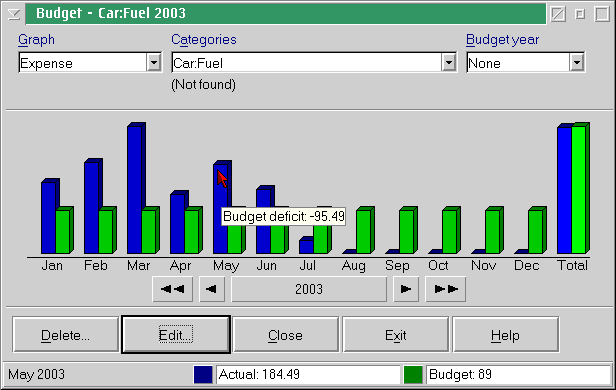

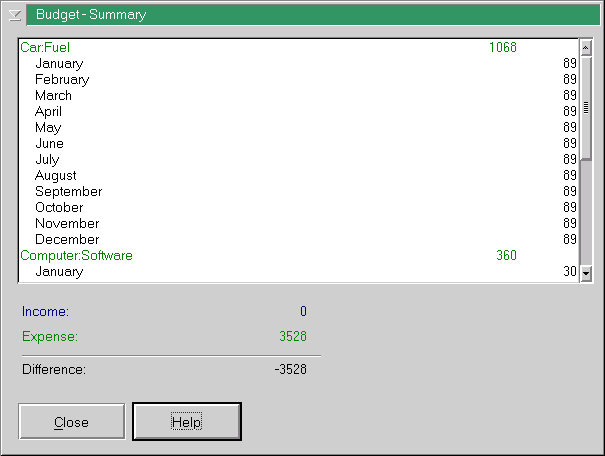

Well, Electronic Teller doesn't quite get off the hook either. To get at the budget function, you actually have to go to the "Graphs" menu functino. There, you'll get a button to either do plain graphing or you can elect to choose "Budget...".

You'll be presented with a graph of your budget shortfalls or surplus', which

is a very nice presentation of the data. (One thing I might wish for is the ability

to change the colours on the graph. No such luck though). There's a drop-down

box in the top right which will allow you to select either Income, Expense or Summary.

You might wonder why I mention this, but it's actually quite important (though I wish

it weren't so). In Income or Expense mode, double-clicking on any of the bars will

do the same thing as pressing the "Edit" button, where you can set your budget

targets.

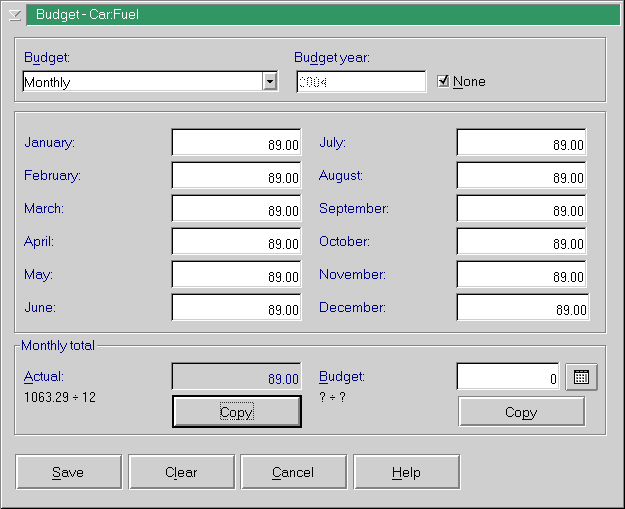

Unlike Moneydance, there's no way to "autoset" your entire budget based on

past expenditures. At least, there is a "Copy" function, which sets the budget

target to be the actual expenditure for the currently selected month. In Summary

mode, double-clicking on the graph bars does something entirely different.

What you'll get instead is the Budget Report window. On the one hand, it's nice

that you get everything in one spot (unlike Moneydance), on the other hand,

this is very inconsistent user-interface behaviour which could be confusing.

At least once you figure out how it works, none of the functions are hard to get

to or gets in your way. This minor foible isn't killer, so for its wealth

of functionality and the things it does do right, I'll give this round to Electronic Teller.

Score:

Electronic Teller 3

Moneydance 2

PLCash 0

Investment Tracking

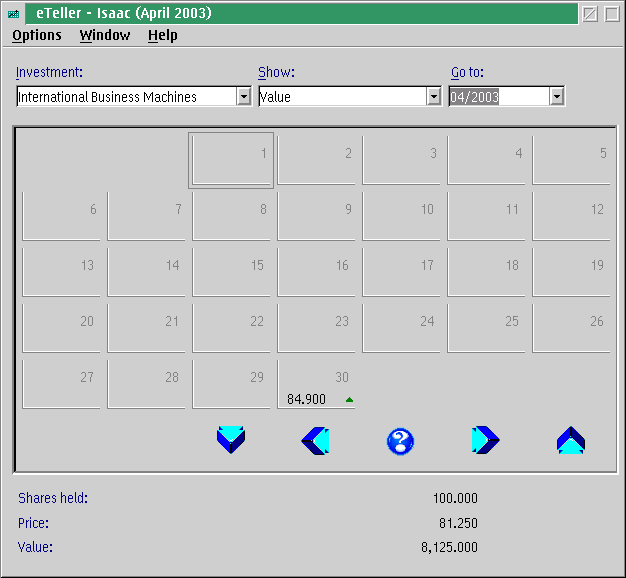

Electronic Teller has an interesting feature in this area. Just find the "Investments"

option in the menus.

You'll get what looks like a calendar (well, it is), with the price listed

for the selected investment and a symbol for up/down/no change. You'll notice

that the bottom part of the screen has the total number of shares, price and total

value. Not too bad, except that you have to entire prices and details

manually as there are no online features yet. The "unique" part is the graphing feature.

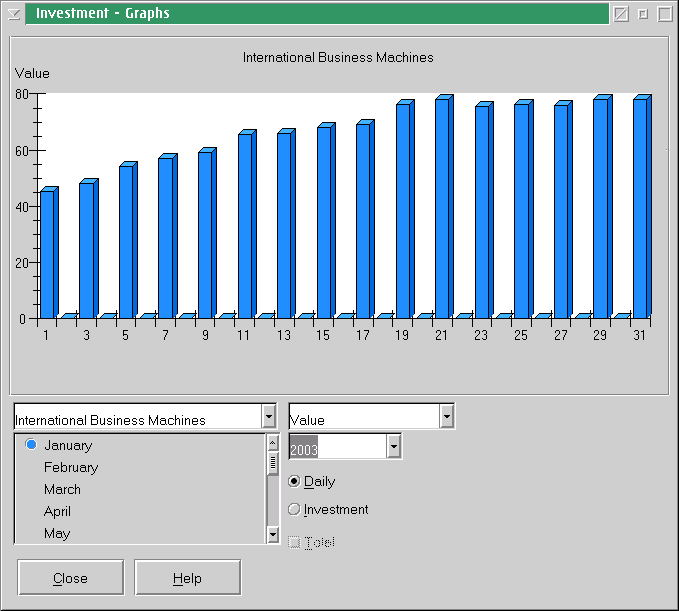

It's ... different. At least compared to what I've seen. The values of the

stocks are plotted on a daily basis, one month at a time. If you want more

than one month, well, it's overlaid on the same graph as yet another sequence

as bar graphs. Okay, so maybe this is a fix for the programming problem of

having to make a dynamically scaleable graph, but for a user, this is a strange

way to view investment performance!

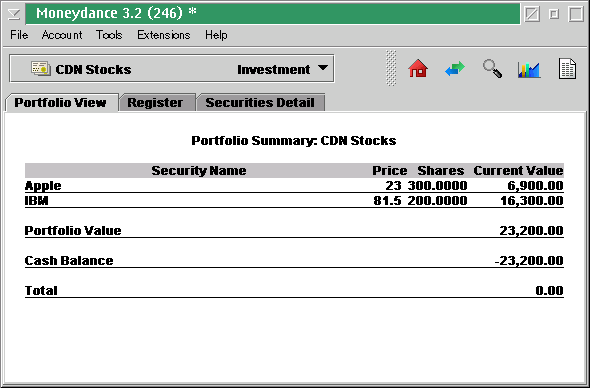

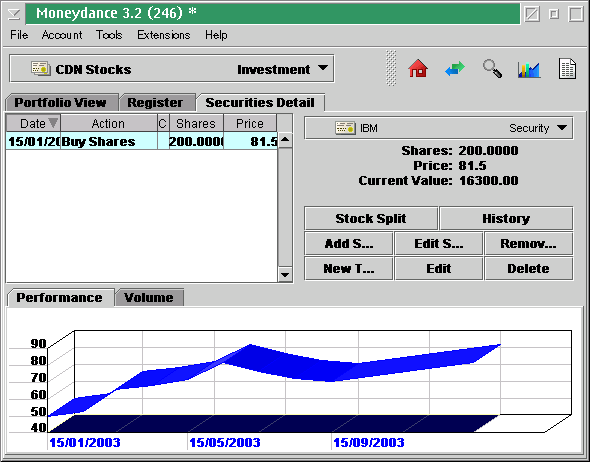

Here is something that Moneydance does pretty much absolutely right.

The Portfolio View is a nice summary of all your investments (in a particular account).

All the information you need to know nicely presented.

The stock performance graph is also done correctly. The appropriate stock is selected via a drop-down dialog, and the graph listed below. Okay, sure the 3-D look is a bit overkill and perhaps even distracting, but its presentation is intuitive and simple. While it doesn't record quite the number of details that Electronic Teller does (which includes volume, close, low, high, etc), it does do the ones that matter most and does it right! Full marks to Moneydance here.

PLCash doesn't have this feature yet.

Score:

Electronic Teller 1

Moneydance 3

PLCash 0

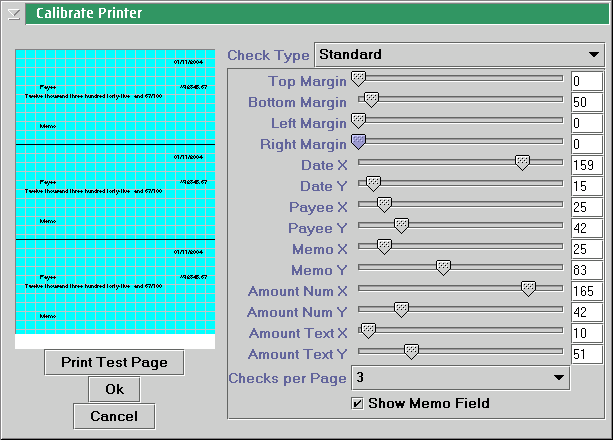

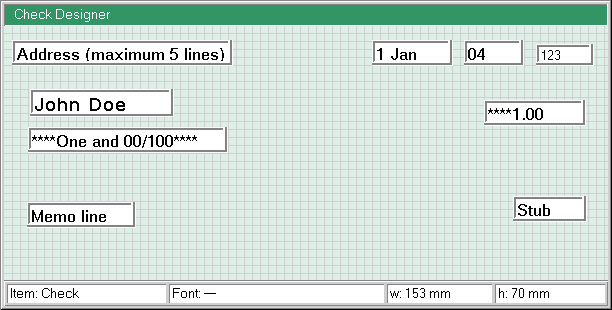

Cheque Printing

PLCash has to sit this one out, so it's again up to the big boys to go up against one another. Moneydance's check printing function is "hidden" under the "Actions" drop-down menu.

You can select multiple transactions to be printed before going to the print function. The selection method is a bit obtuse, however. You must select a transaction, and then under the "Check#" drop-down selection box, you choose "{Print}", and then you must save/record the transaction before you continue. There are a few layouts, and a useable customization screen to get the layout just right.

With Electronic Teller, you get pretty much the same functionality, but I think

it is much easier to use. To select multiple transactions for print, just do what

you think you ought to do. Hold down the CTRL key while selecting the entries

you need with the mouse button. Then just go to the menu item to print cheques.

Now you have the choice of the "original" designer or the "alternate" one.

The alternate designer gives you fine control of the field positioning by

entering the precise (X,Y) coordinates. But you'd have to print a preview.

What really impressed me was the original design utility, pictured above.

You get a graphical representation of the cheque, and you can drag the fields

around as you wish (and very handy, the X,Y coordinates are displayed in the status

bar at the bottom when you're dragging a field around). Yes, you can even drag 'n drop from the Font Palette to

change the font of each field! Moneydance fans, I'm sorry, I thought Moneydance

did it pretty well until I saw what Electronic Teller could do!

Score:

Electronic Teller 3

Moneydance 2

PLCash 0

Data Import/Export

Like it or not, Quicken has been the defacto standard for quite a while now. It's fairly critical to support this file format. PLCash appears to only use QIF as the file format. One problem I found was that it seemed to have a problem importing a multi-account QIF file (I tried an exported file from both Electronic Teller and Moneydance) properly, only the first account showed up. However, on subsequent startups, once it figured out where the "default" file was, it seemed to load it up properly.

Moneydance handled the multi-account QIF properly without any problems. In addition, it will also import OFX (Open Financial eXchange) files. Export options include QIF, TAB separated text file and Moneydance's own XML format.

Electronic Teller is also very complete, in addition to its own file format, it is able to import QIF, OFX, CSV (comma separated text) and export QIF and CSV.

I found it strange that none of the packages were able to export OFX format, even though 2 of them could import the format. I guess QIF is the standard, and is the one common file amongst all of them. PLCash sort of falls down here, and has a lot of catching up to do.

Score:

Electronic Teller 3

Moneydance 3

PLCash 1

Encryption

Of course, the ability to keep your financial data secret can be very important. PLCash is the only one that doesn't offer any encryption (though I'm sure it will come sooner or later, as long as someone brings it up). Moneydance offers the ability to encrypt your files with a password key, but the method is not specified. Electronic Teller includes built-in support for encryption, but you must separately download the Blowfish 448-bit encryption module (free), which is well-known and commonly used. (Those interested can head over to Bruce Schneier's page, the creator of Blowfish. It's free, open-source and has been analyzed by quite a few security experts, and is so far, pretty darn good).

Score:

Electronic Teller 3

Moneydance 2

PLCash 0

On-line features

Quicken 98 had on-line features to automatically update my stock prices, and other tasks. That was one feature I really liked, and I think it would be a necessity for today's applications.Here is where Moneydance really shines and stands well above the other two. It has features for on-line updating of stock prices, currency exchange rates, it can grab transaction records from your bank (if your bank supports it), and can even handle the Paytrust (not Paypal!) online bill payment service. Moneydance can even be configured to check for new versions of itself during startup.

PLCash is lacking in on-line abilities as well, however, this isn't a surprise given its relative youth and generally small feature set. Hopefully, this is something that will come soon.

Online features is one area which Electronic Teller absolutely falls flat. As in there are none whatsoever. At the minimum, I would like to have automated exchange rate and stock price updates, especially given its rather cumbersome manual method of entering daily stock prices. Sadly nothing. That's not to say all is bleak. I contacted the author and also just happened to accidentally ;-) send him some sample Rexx code which retrieved stock information from Yahoo!. Last I heard from him, he was pretty excited and was madly hammering away at new code.

Score:

Electronic Teller 0

Moneydance 3

PLCash 0

Help and Documentation

PLCash's embedded help and documentation are one and the same. It comes as HTML files, which you can access via an external browser, or PLCash's own internal browser (which you can access by clicking on the Help button). It may not be flashy, but it is relatively complete and well written. The only catch is, aside from the non-availability of context sensitive help, as you can imagine, it can take some time to parse a rather lengthy HTML file! It also succumbs to the same failings as Moneydance's on-line help, which is lack of a real index or a search feature.

Moneydance has its own online documentation files (again, no specific help files), which are viewable by a simple Java help viewer, which looks suspiciously like HTML files. Unfortunately, these are not accessible via an external browser. It's also fairly complete and detailed, including screenshots when applicable. Unfortunately, some of the screenshots were so scaled down, it's hard to see enough detail. Also, I noticed that some of the "links" to the screenshots seemed to be broken. The documentation is complete, but lacks polish. There is no proper index, despite having an "Index" button (it's really more like the Table of Contents), and there's no search feature, so it can make life a bit difficult looking for a particular topic.

In a group of applications with adequate documentation, Electronic Teller stands above the others. The help and documentation are also one and the same file. It uses OS/2's "standard" help format. However, it is effectively separate because it is context sensitive (unlike the others), providing you the appropriate help no matter where you happen to be in the application. This is activated by the "Help" button, pressing "F1" or you can access the general Help file via the text menu on top. The help files are very well written, and contain screenshots to help you along. If you ever find yourself wondering how to do something, just press "F1"!

There's no competition here, Electronic Teller's documentation and on-line help is simply the best. Absolutely professional quality!

Score:

Electronic Teller 3

PLCash 1

Moneydance 1

Developer Responsiveness

One would hope that these small (normally 1 developer!) projects would be more friendly and responsive to users. It would be, at the last, tough not to beat Intuit's infamous customer "service" (if you could call it that) charged at $1.95 per minute!

Both PLCash and Moneydance have obviously listened to the fact that OS/2 users are consuming their product, as each have fixes, notes and specific facilities for OS/2 users. In the case of PLCash, it seems a fix and documentation update was quickly issued to fix a problem with locating OS/2's browser. Moneydance's trial download asks which platform you are using, and if OS/2 is selected, you get that nice .CMD startup file that runs perfectly under OS/2, locating the appropriate JVM and starting up the application properly. Both of these are good clues that the developers listen to OS/2 users!

Electronic Teller, obviously, is targetted exclusively towards OS/2 users. But is he responsive? I'm pleased to say yes! Immediately after the release of the latest version, I discovered that it included a great feature that automatically turns on the NUMLOCK key, and made sure it was kept on, when Electronic Teller was running. Great, except if you're working on a laptop with no numeric keypad! Upon contacting the author, he immediately provided a fix to turn off this feature. How's that for service?

Score:

Electronic Teller 3

PLCash 3

Moneydance 3

Price

You can't beat free, so PLCash has to be the winner here, if only price is concerned. (Which, of course, it isn't). As to the rest, I'm going to call it a tie between Electronic Teller ($40 US or $45 CDN) and Moneydance ($29 US). Both are reasonably priced and the $11 US difference between the two are unlikely to be the deciding factor, unless all things are equal (which they're not). Besides which, depending on the current conversion rate, you'll notice that $45 CDN is close to $29 US. (In fact, several months ago, Electronic Teller would've come out cheaper).

Score:

Electronic Teller 2

Moneydance 2

PLCash 3

Conclusion

| Category | Electronic Teller | Moneydance | PLCash |

| Requirements | 3 | 2 | 2 |

| Installation | 3 | 3 | 0 |

| User Interface | 3 | 2 | 1 |

| Multi-Currency Support | 3 | 3 | 0 |

| International Support | 3 | 3 | 0 |

| Graphs | 3 | 3 | 0 |

| Reports | 3 | 2 | 2 |

| Budgeting | 3 | 2 | 0 |

| Investment | 1 | 3 | 0 |

| Cheque | 3 | 2 | 0 |

| Import/Export | 3 | 3 | 1 |

| Encryption | 3 | 2 | 0 |

| On-line | 0 | 3 | 0 |

| Documentation | 3 | 1 | 1 |

| Support | 3 | 3 | 3 |

| Price | 2 | 2 | 3 |

| Total | 42 | 39 | 13 |

I have to admit, I was surprised at the results. I had expected a really close race between Moneydance and Electronic Teller, and I guess it was. But the totals speak for themselves though. Of course, if you have different priorities, the winner may come out differently. But for this evaluation, Electronic Teller is easily the winner.

Yes, another corny line, but the real winner here is us, the OS/2 users. We have a good choice between 3 very good applications. If you have basic needs, PLCash will fill that niche easily. It's light, fast and free.

If English is not your language, you're limited to Electronic Teller or Moneydance, (Except you lucky German speaking users, can choose also from Moneyplex).

For heavier duty use, you can choose between Electronic Teller or Moneydance. If you're pondering a switch to another platform, or if on-line features are an immediate requirement, then Moneydance is the obvious choice. On the other hand, if you're still running a Java-less system, or prefer light-weight and speed, you can pick Electronic Teller.

As for me, what did I choose? After playing around with each for a bit,

I ended up with Electronic Teller. The on-line features, while desirable, weren't

absolutely necessary to me, and everything else worked that much better.

|

Previous Article |

|

Next Article |